Petroleum Post 7/11/2025

Prices fell in today's session to erase the early gains. Markets appear fairly priced currently.

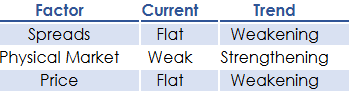

Day Change Summary

September Brent, September WTI crude, diesel, and gasoline are the most active contracts currently and were used in the following tables. Markets mixed on the week with gasoline gaining but the rest of the complex falling slightly. Today’s trading session saw markets sell off after a weak rally at the start of the week. Crude oil prices are below their 200-day moving averages while refined products remain above them. Refined product markets have been showing more resilience than crude, likely due to strong demand and drawing down of inventories. Gasoline appears to be taking the lead over heating oil, after spending the past two weeks in the rear seat.

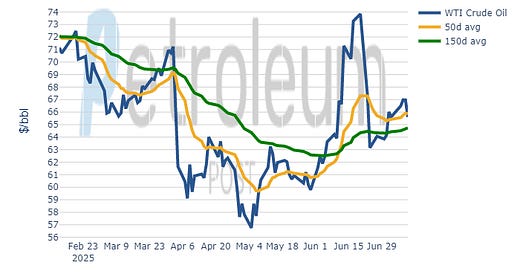

WTI Crude Oil

Source: ICE, CME

WTI prices erased all of their gains on the week in today’s trading session. There will likely be more downward price action ahead as short-term moving averages were passed in today’s session. OPEC announced its production increases for August which were higher than original plans, but the market had likely already priced this in. The most recent EIA STEO report moved our price model lower – to an expectation of $66.70 average for Q3 of 2025. Markets have had a very sideways-to-upward trend to start the month, and physical markets appear to be strengthening. However, the expectations of a looser market ahead could provide a lid to how high prices can go in the interim.

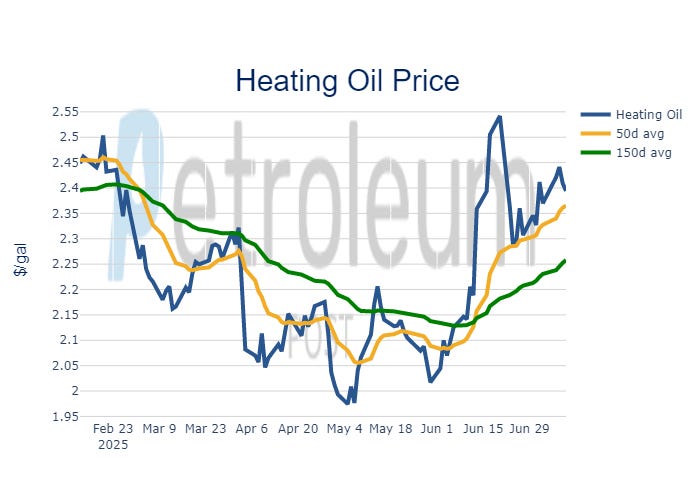

NYMEX Heating Oil

Source: ICE, CME

Diesel prices softened on the week after leading the complex the past several weeks. Market structure is still strong, indicating a tight diesel market and the trend is still up. Diesel supplies should shift toward builds in the months ahead prior to the fall season, but we have yet to see any substantial amount of builds and the structure of the market is not really incentivizing storage. Diesel prices should cool off in the week ahead as the whole complex takes a breathe, but markets are far from outright bearish.

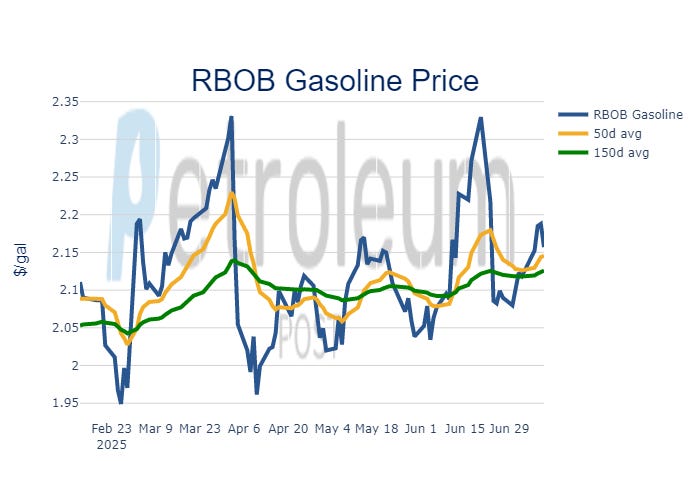

NYMEX RBOB Gasoline

Source: ICE, CME

Gasoline markets rallied on the week and gasoline crack spreads improved. Fundamentals are not extremely strong and gasoline demand for the Fourth of July weekend was weaker than 2024. Gasoline market momentum has not shifted lower like the rest of the complex so expect a bit more resilience than diesel next week.